Opportunities in Volatility - अवकाश

The journey of investing in markets is often filled with volatility, tempting many to time the market. The case below vividly underscores a powerful investment principle: time in the market beats timing the market.

The Case for Staying Invested

-

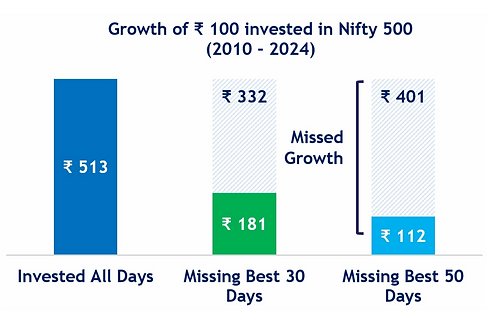

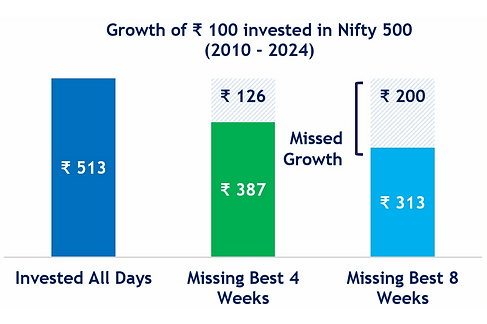

The most critical driver of long-term returns is staying invested in the market, and the below analysis of ₹100 invested in the Nifty 500 index over the period 2010–2024 is a strong testament to this principle. If you had remained invested in the Nifty 500 on all trading days, your ₹100 would have grown to ₹513. Missing just the best 30 days reduces your returns significantly by 65%, leaving you with only ₹181. Skipping the best 50 days drops the return to a mere ₹112, effectively forfeiting most of the potential gains. Another way to dissect the returns is through weeks instead of days. Avoiding the market during the best 4 weeks reduces returns by 25% to ₹387. Missing the best 8 weeks further cuts returns to ₹313. These data emphasise that market timing is often a counterproductive strategy. The best days and weeks of market performance often occur unpredictably, and missing these can drastically impact your investment outcomes. The key is to remain patiently invested with a framework one is comfortable with.

Beyond the Surface: Uncovering Opportunities in an Expensive Market

Indian market style evolution

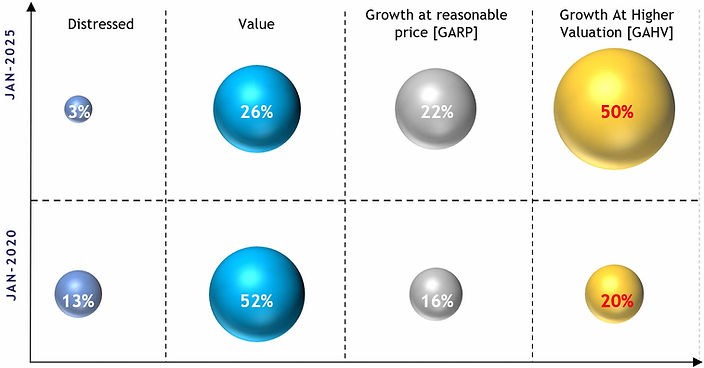

Data Source: Ace Equity. The percentage inside the bubbles represents the number of stocks in the particular style. Style classification is based on Vaikarya’s proprietary method, which combines several factors in addition to Valuation.

In today’s market landscape, it’s easy to feel that everything has become prohibitively expensive. While valuations for NIFTY50 or large-cap stocks may not seem alarmingly high compared to historical levels, many investors perceive that every second stock appears overpriced—and there’s a reason for that. We’ve categorised stocks with a market capitalisation of over ~$100 million into four distinct buckets: 1) Distressed Companies, 2) Value, 3) Growth at a Reasonable Price (GARP) and 4) Growth at High Valuation (GAHV). Five years ago, only 1 in 5 stocks belonged to the high-valuation (GAHV) category. Today, that ratio has surged to 1 in 2 stocks. Despite the rise in high-valuation (GAHV) stocks, the investable universe has expanded significantly, from 658 stocks five years ago to 1,116, aided by 266 IPOs and other corporate actions. Excluding GAHV stocks and extreme distress, there are still 533 investable companies today, up from 446 in January 2020. This means the opportunity for concentrated funds is equally favourable, if not more so.

Vaikarya’s Approach: Transformative Changes

Screen for Transformative Changes

- At Vaikarya, we screen for transformative changes with a long growth runway, such as management shifts, strategic realignments, industry or regulatory cycles, corporate actions (e.g. demergers), and market share gains.

Under-Discovered or Under-Appreciated Across Market Caps

-

We avoid overvalued Growth at High Valuation (GAHV) segments, which historically have delivered lower returns. Note that Large caps can also be underappreciated of transformative changes that lead to multi-bagger stocks. For example, we reaped stellar returns from our investment in ICICI Bank and Tata Communications in 2018.

Position Sizing is a Function of Price, Conviction and Risk

-

We use a structured position sizing framework, balancing return scenarios, probabilities of those scenarios, and risks. Current market conditions do offer opportunities to accumulate high-conviction positions at attractive prices, positioning the fund for substantial returns.

Fund Performance

-

Fund outperformed over the quarter with -2.03% returns compared to -8.39%/-7.71% for the NIFTY 50/NIFTY500.

Notes:

-

23 August 2024 is the date of the First Allotment of the Fund.

-

The fund performance mentioned above is the performance of the earliest external client in the Fund using the Time-Weighted Rate of Return (TWRR) methodology, and the performance of an individual client may vary significantly from the above.

-

Returns for one year or less are on an absolute basis.

-

Past performance may or may not be sustained in future and is no guarantee of future results.

-

Please note that the performance of one investor in the portfolio may vary significantly from that of other investors and that generated by the Investment Approach across all investors because of :

-

the timing of inflows of funds; and

-

varied fee structure

-

-

Portfolio returns are after management fees and other expenses.

-

Market caps are approximated as of January 10, 2025. Sources: Ace Equity and publicly available disclosures.

Annexure: Regulatory Disclosures as on Dec 31st 2024

Investee Company Financial Information

Notes:

-

Revenue, PAT, and Net Worth figures represent the trailing twelve months (TTM) period based on the latest interim results available (as of Dec '24 / Sep '24). Market cap are approximated as of January 29, 2025. Source: Ace Equity.

-

Jubilant Industries Limited was amalgamated with Jubilant Agri and Consumer Products Ltd (JACPL) on October 3rd, 2024. The market cap is as of October 25th, 2024 (last traded value). JACPL will be filing for listing shortly. Figures for JIL are for the TTM as of June 2024 or March 2024.

-

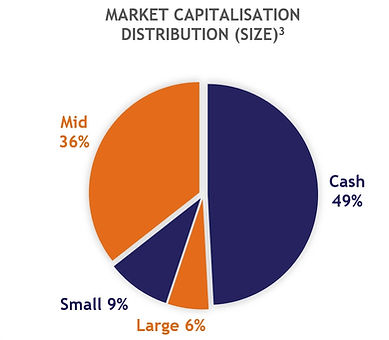

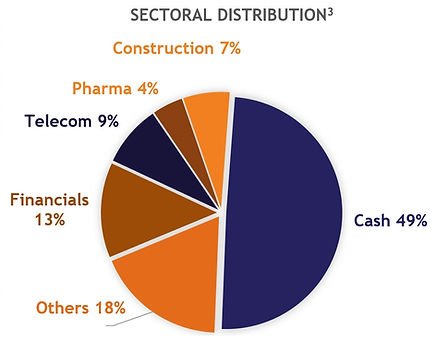

The portfolio distribution across size and sector is as of December 31, 2024, excluding fund flows on that date.

-

Vaikarya Change LLP is the sponsor of Vaikarya Change India Fund and holds a continuing interest of ~ ₹ 10 Cr for the fund's lifetime.

Risk Disclosures:

-

Concentration Risk: The portfolio is diversified across multiple sectors and key economic indicators, mitigating concentration risk.

-

Foreign Investment Risk: The Fund does not hold investments in foreign entities, eliminating exposure to foreign investment risks.

-

Leverage Risk: The Fund operates without the use of leverage. Hence, there is no leverage risk.

-

Realization Risk: Portfolio investments consist of listed or soon-to-be-listed entities, providing clarity on potential realization pathways and resulting in negligible realization risk.

-

Strategy Risk: The portfolio remains fully aligned with the stated strategy of Vaikarya Change India Fund, which has been consistently maintained since inception.

-

Reputation Risk: Investments are restricted to listed or soon-to-be-listed entities, ensuring adherence to high governance and transparency standards, resulting in negligible reputation risk.

-

ESG Risk: The Fund adheres to established ESG practices and believes that portfolio companies also follow strong ESG principles.

-

Fees: Fees are charged as per the Private Placement Memorandum (PPM) read with Fund Documents.

Disclaimer

This document (the “Letter”) is being furnished to you by Vaikarya Change LLP (“Vaikarya”) and its authorized agents on a confidential basis solely for the purpose of providing information regarding Vaikarya and an investment in Vaikarya Change India Fund (“Fund”), which is a scheme of Vaikarya Change India Trust (“AIF”). Vaikarya Change India Trust is registered with SEBI as a Category III Alternative Investment Fund having registration number IN/AIF3/24-25/1536.

The information contained in this Letter is confidential to the person, company, partnership, or other entity to whom it is given (the “Recipient”) and, without the prior written consent of Vaikarya, should neither be disclosed to any other person, company, partnership, or other entity (except to the Recipient’s legal counsel and/or other professional advisers), nor copied nor reproduced in whole or in part. This Letter must be returned, along with any supplemental information provided to the Recipient, and any copies destroyed, immediately upon the request of Vaikarya. By accepting delivery of this Letter, each Recipient agrees to the foregoing and the terms and conditions below. This Letter is prepared by Vaikarya strictly for the specified audience and is not intended for distribution to the public and is not to be disseminated or circulated to any other party outside of the intended purpose. This Letter is not directed to, nor intended for distribution or use by, any person or entity in any jurisdiction or country where the publication or availability of this Letter or such distribution or use would be contrary to local law or regulation.

This Letter is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. This Letter is not, and under no circumstances is it to be construed as, an offering document or an advertisement, and the furnishing of this Letter to the Recipient is not, and under no circumstances is it to be construed as, an offering (public or otherwise) of interests in the Fund. The contents of this document should not be treated as advice relating to investment, legal, or taxation matters. It is recommended that the Recipient consult their stockbroker, banker, legal adviser, and other professional advisers to understand the contents of this Letter. Vaikarya does not provide legal or tax advice, and if necessary, you should approach independent professional tax or legal advisors to obtain the same.

This document is confidential, and any unauthorized use or reproduction of any information contained in this document is strictly prohibited. The views in this document are generally those of Vaikarya and are subject to change without notice, and Vaikarya is not under any obligation to update its views or the information in this document. Neither Vaikarya, nor its promoters, directors, officers, employees, or representatives shall accept any responsibility for any direct, indirect, or consequential loss suffered by you or any other person as a result of you acting, or deciding not to act, in reliance upon such information, opinions, and analysis. The contents of this document have not been reviewed by any regulatory authority in India or in any other jurisdiction. If you have any doubt about any of the contents of this document, you should obtain independent professional advice.

The portfolio of the Fund is subject to changes within the provisions of the Private Placement Memorandum of the Fund. Investments are subject to market risks. Past performance is not an indicator of future performance, and there can be no assurance or guarantee that any investment will achieve any particular return. The performance of the Fund may be adversely affected by the performance of individual companies, changes in the market conditions, micro and macro factors, and forces affecting capital markets, including interest rate risk, credit risk, liquidity risk, and reinvestment risk. Fund will be exposed to various risks depending on the investment objective, investment strategy, and the asset allocation. The sector(s)/stock(s)/issuer(s) mentioned in this document do not constitute any research report/recommendation of the same, and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). Any projections, forecasts, and estimates contained in this Letter are necessarily speculative in nature and are based upon certain assumptions. It can be expected that some or all of such assumptions will not materialize or will vary significantly from actual results. All projections, forecasts, or “forward-looking statements” relating to expectations regarding future events or the possible future performance of the Fund contained in this Letter are those of Vaikarya only and represent Vaikarya’s own assessment and interpretation of information available to it as at the date of this Letter and are subject to change without notice as a result of known and unknown risks, uncertainties, and other factors which may cause actual results or eventualities to be materially different from those contemplated in such statements.

The Recipient should not treat the contents of this Letter or any prior, or subsequent, communications from Vaikarya, any of its affiliates or any of their respective directors, officers, employees, partners, members, agents, professional advisers, representatives, and/or consultants as advice relating to legal, taxation, or investment matters and are advised to consult their own professional advisers concerning the acquisition, holding, or disposal of interests in the Fund.