Normalization - स्र्पष्टतर

-

In our Apr 2025 letter – “Bottoming – पुनरुत्थान”, we mentioned that the markets are showing signs of bottoming and that the investors should use that opportunity to increase their equity exposure. Since then, the markets have recovered very well.

MARKET RECOVERY

The small-cap 250 index is rebased to 100 for various periods of correction

-

Similar to the beginning of the year, multiple expansion is likely to be more measured from here given the high starting valuations, so future stock gains will rely on actual earnings growth delivery.

Data Source: Ace Equity. The percentage inside the bubbles represents the number of stocks in the particular style. Style classification is based on Vaikarya’s proprietary method, which combines several factors in addition to valuation.

PORTFOLIO STRATEGY AMIDST A VOLATILE GLOBAL ENVIRONMENT

-

The global environment was extremely volatile over the last few months, marked by US tariffs, the Middle East conflict, and a brief war between India and Pakistan. The key event is the relative tariffs India receives from the US, as these tariff outcomes are expected to be settled over the next few weeks. The Indian macro and liquidity environment is much more benign now than at the start of 2025. Interest rates have come down, inflation is under control and the government’s continued focus is on infrastructure and manufacturing. Flows have been supportive, hence the Nifty is up ~7% for the year, showing resilience of the Indian markets. It provides exciting growth opportunities for nimble, smaller firms. We are approaching small caps with a quality bias within the “GARP” and “Value” styles.

-

Over the last 3 months, we have deployed our cash and, given the prevailing global uncertainty, have skewed our portfolio towards businesses with domestic exposure. Notably, we have exited some of our IT positions and increased our exposure to tracked opportunities in BFSI, manufacturing, construction, and healthcare companies. Needless to say, we are closely monitoring global events and tracking a select group of companies for long-term opportunities

IMPACT ON PORTFOLIO

-

The impact of all these uncertainties on our portfolio companies has been minimal since the US exposure for our companies was limited. Furthermore, we have restructured the portfolio to trim this exposure even more till further clarity emerges and we get conviction on industry cycles and companies that can benefit from any possible re-alignment of the global supply chains. As of the day of writing this letter, we remain overweight on companies anchored to domestic growth with a firm eye on the changing global economic indicators.

Portfolio Performance and Positioning

PORTFOLIO PERFORMANCE

Source: Fund returns are after management fees and other expenses.

-

For the 1 & 3 months ending 30th June 2025, the fund delivered +120 & +50 bps relative to NIFTY500.

-

The following factors have contributed positively.

-

The financial sector and select small-cap stocks contributed materially on both an absolute and relative basis. As highlighted in prior letters, we acted upon building positions ahead of the credit cycle turn in select financial stocks, such as scaling up L&T Finance and IDFC, while taking fresh positions in Fedbank Financial, Aditya Birla Capital and RBL Bank.

-

Select small caps, such as Interarch, performed well with strong quarterly results.

-

The following factors dragged down the returns

-

Healthcare/Pharma positions underperformed. While domestic ones (e.g. Windlas) had moderate quarterly results, one global pharma stock (Piramal Pharma) turned weak amid the US tariff narrative.

-

Select small caps in the portfolio (e.g. Capacite) underperformed due to weaker results.

PORTFOLIO POSITIONING

-

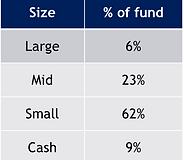

Over the last quarter, we have deployed cash (reducing from 27% to 7% levels) on tracked opportunities in Financials, Engineering, Healthcare/Pharma (domestic mainly), etc. We have made meaningful shifts to align the portfolio with evolving macro risks, like tactically reduced positions in IT Services and export-oriented companies. As a result, our core positioning has become more India-centric. Our largest sector allocation, Financials, benefits from improving trends in unsecured credit and regulatory easing under the new RBI governor.

Valuation data represents a weighted average across the fund’s positions. Forward P/E is used, except for turnaround stocks (approximately 5% of the fund), where a 24-month forward P/E is applied. Returns (ROE/ROIC) are incremental or based on a 12-month forward view. Growth rates are forward-looking, steady-state, and measured at the top-line level.

L&T Finance – Transformation-led re-rating in play

-

L&T Finance represents a classic Vaikarya multi-bagger setup — a company with a legacy discount, mispriced due to short-term headwinds, yet executing a strategic transformation under new leadership to change its orbit towards Tier 1 NBFC. The company has transitioned into a retail-focused, cutting-edge tech-enabled lender with improving RoA, resilient asset quality, and high-conviction management.

Source: Trading Veiw

-

As we highlighted in our December 2024 letter (see chart above), we closely tracked the MFI cycle, which was causing dislocations in stocks such as LTF – a potential multi-bagger over the years. We had a position under 2% in LTF at the beginning of 2025. We scaled up the position to 9+% by early April. With substantial gains over the last 3 months, we trimmed exposure due to SEBI’s 10% ceiling but continue to hold LTF as a core position for long-duration compounding.

-

Beneath the near-term clouds of a microfinance credit cycle, we believe the market has been misunderstanding the speed and effectiveness of LTF’s transformation. The market? Still stuck on the lost decade till 2023 with the stock, followed by microfinance noise, and yesterday’s headlines.

-

Meanwhile, the company has gone almost fully retail (97% of the loan book!), shut down its legacy wholesale business, and brought in a top-tier CEO from ICICI Bank who’s reshaping the house faster than anyone expected.

-

The new LTF is using proprietary AI (tools called Cyclops and Nostradamus) to underwrite smarter and cut losses before they show up. In just one year, delinquency in two-wheelers has reduced by 120 bps, and high-risk loans were proactively flagged, and their share in new loans was reduced from 11% to 3%. Even farm indexed bounce rates improved from 159% to 38%. That’s not just cleanup — it’s a full-system upgrade. These outcomes, while not yet fully appreciated by the market, provide early evidence that LTF’s new tech-enabled approach is delivering tangible credit benefits. Regulatory tailwinds, such as the adoption of Account Aggregator frameworks, further strengthen LTF’s ability to compete effectively, even against many banks, given its low cost of funds (AAA rating).

-

They're also entering high-ROA, low-risk products, such as gold loans (via a strategic acquisition), and launching micro-LAP. With 9 million active customers and growing, the cross-sell opportunity is massive and profitable. LTF isn’t just surviving the microfinance storm — it’s quietly becoming the last man standing with 3-lender cap. As weaker MFIs fade, LTF’s credit costs could fall fast, and what looks like a messy loan book today might be a great value in future.

-

Here’s the kicker: even after delivering 2.44% RoA during peak MFI stress, the stock still trades at ~1.6x book and ~13x earnings — vs Tier 1 NBFCs trading at 3.5-4.5x book - not expensive for an NBFC, let alone one reinventing itself with tech, prime customer focus, and a shot at 3.0% RoA and nearly doubling the balance sheet over the next 3 years.

Source: Ace Equity. Stock prices indexed to 100 from respective turnaround years — Bajaj Finance (2011), Cholamandalam Finance (2014), L&T Finance (2023). Y-axis is in log scale.

Disclaimer

This document (the “Letter”) is being furnished to you by Vaikarya Change LLP (“Vaikarya”) and its authorized agents on a confidential basis solely for the purpose of providing information regarding Vaikarya and an investment in Vaikarya Change India Fund (“Fund”), which is a scheme of Vaikarya Change India Trust (“AIF”). Vaikarya Change India Trust is registered with SEBI as a Category III Alternative Investment Fund having registration number IN/AIF3/24-25/1536.

The information contained in this Letter is confidential to the person, company, partnership, or other entity to whom it is given (the “Recipient”) and, without the prior written consent of Vaikarya, should neither be disclosed to any other person, company, partnership, or other entity (except to the Recipient’s legal counsel and/or other professional advisers), nor copied nor reproduced in whole or in part. This Letter must be returned, along with any supplemental information provided to the Recipient, and any copies destroyed, immediately upon the request of Vaikarya. By accepting delivery of this Letter, each Recipient agrees to the foregoing and the terms and conditions below. This Letter is prepared by Vaikarya strictly for the specified audience and is not intended for distribution to the public and is not to be disseminated or circulated to any other party outside of the intended purpose. This Letter is not directed to, nor intended for distribution or use by, any person or entity in any jurisdiction or country where the publication or availability of this Letter or such distribution or use would be contrary to local law or regulation.

This Letter is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. This Letter is not, and under no circumstances is it to be construed as, an offering document or an advertisement, and the furnishing of this Letter to the Recipient is not, and under no circumstances is it to be construed as, an offering (public or otherwise) of interests in the Fund. The contents of this document should not be treated as advice relating to investment, legal, or taxation matters. It is recommended that the Recipient consult their stockbroker, banker, legal adviser, and other professional advisers to understand the contents of this Letter. Vaikarya does not provide legal or tax advice, and if necessary, you should approach independent professional tax or legal advisors to obtain the same. This document is confidential, and any unauthorized use or reproduction of any information contained in this document is strictly prohibited. The views in this document are generally those of Vaikarya and are subject to change without notice, and Vaikarya is not under any obligation to update its views or the information in this document. Neither Vaikarya, nor its promoters, directors, officers, employees, or representatives shall accept any responsibility for any direct, indirect, or consequential loss suffered by you or any other person as a result of you acting, or deciding not to act, in reliance upon such information, opinions, and analysis. The contents of this document have not been reviewed by any regulatory authority in India or in any other jurisdiction. If you have any doubt about any of the contents of this document, you should obtain independent professional advice.

The portfolio of the Fund is subject to changes within the provisions of the Private Placement Memorandum of the Fund. Investments are subject to market risks. Past performance is not an indicator of future performance, and there can be no assurance or guarantee that any investment will achieve any particular return. The performance of the Fund may be adversely affected by the performance of individual companies, changes in the market conditions, micro and macro factors, and forces affecting capital markets, including interest rate risk, credit risk, liquidity risk, and reinvestment risk. Fund will be exposed to various risks depending on the investment objective, investment strategy, and the asset allocation. The sector(s)/stock(s)/issuer(s) mentioned in this document do not constitute any research report/recommendation of the same, and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). Any projections, forecasts, and estimates contained in this Letter are necessarily speculative in nature and are based upon certain assumptions. It can be expected that some or all of such assumptions will not materialize or will vary significantly from actual results. All projections, forecasts, or “forward-looking statements” relating to expectations regarding future events or the possible future performance of the Fund contained in this Letter are those of Vaikarya only and represent Vaikarya’s own assessment and interpretation of information available to it as at the date of this Letter and are subject to change without notice as a result of known and unknown risks, uncertainties, and other factors which may cause actual results or eventualities to be materially different from those contemplated in such statements.

The Recipient should not treat the contents of this Letter or any prior, or subsequent, communications from Vaikarya, any of its affiliates or any of their respective directors, officers, employees, partners, members, agents, professional advisers, representatives, and/or consultants as advice relating to legal, taxation, or investment matters and are advised to consult their own professional advisers concerning the acquisition, holding, or disposal of interests in the Fund.